how much is mortgage protection insurance per month

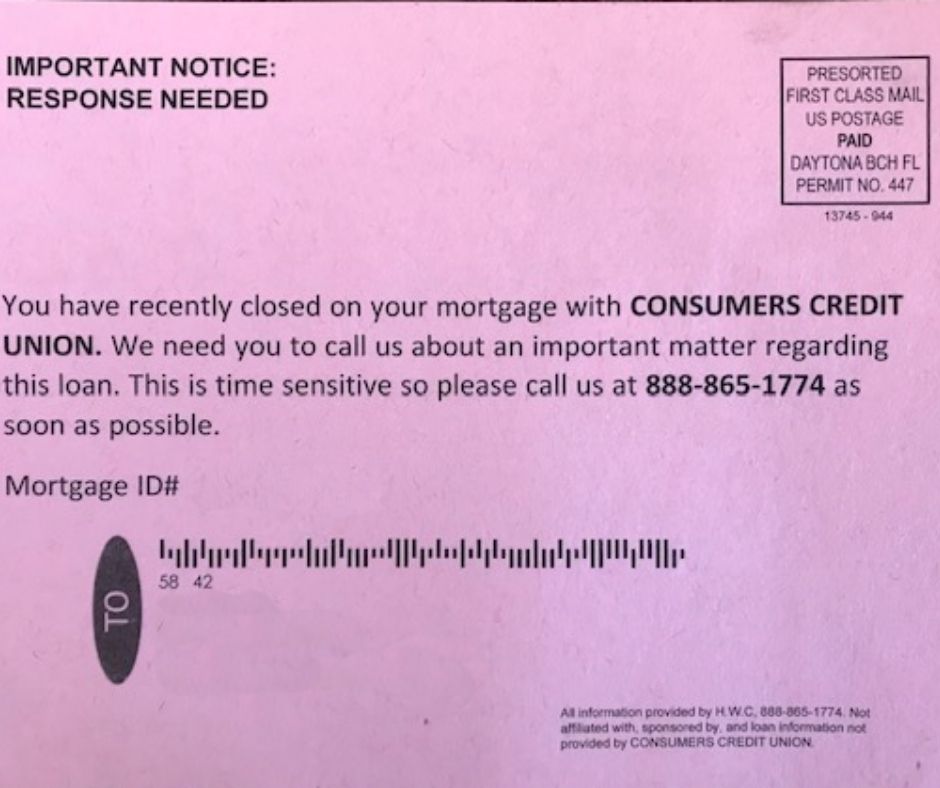

It's essential to recognize the warning signs of insurance fraud involving mortgages. It's equally important to be aware that most offers are genuine. If you're interested in this kind of insurance, follow the tips listed below when filling out an interest form or make a call to ensure the company is authentic and trustworthy.

Several insurance firms will be in the pile of people telling you that you must safeguard your mortgage by acquiring a "mortgage security insurance" policy. It's common for mortgage holder to aid their family in staying at home if they die suddenly.